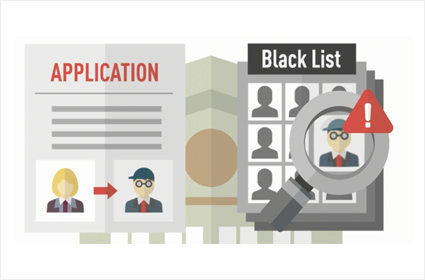

WLS(Watch List Screening)

Get your threats accurately pinpointed!

Watchlists consisting of PEPs, OFAC etc. is key to AML process. Watchlists can be broadly classified into two types, lists from third party vendors and your own. AMLion is capable of importing any list you wish to utilize for screening.

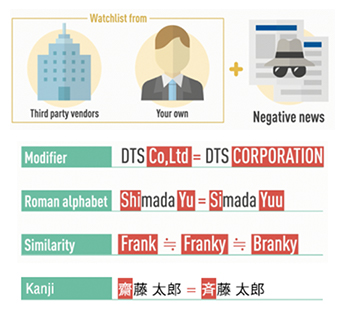

Also with AMLion, based on customizable system preset negative words, AI searches the news information and finds negative news which matches with your customer’s information. It is equipped with sophisticated Fuzzy Matching functionality which greatly reduces detection leaks. For alphabetic letters, AMLion detects possible modifiers, roman alphabets and similarities. Fuzzy Matching also supports Kanji-variants.