Aiming to establish highly transparent management, continually enhance corporate value, and build relationships of trust with stakeholders

Status of Compliance with the Japan's Corporate Governance Code

The Company complies all Principles of the Corporate Governance Code. Please refer to Corporate Governance Report for details.

basic idea

basic way of thinking

The Company recognizes corporate governance as one of the most important management issues. The Company has established the following basic policy and is working aggressively to develop corporate governance and internal control systems in order to ensure fair and efficient shareholder-oriented management, establish highly transparent management, continuously improve corporate value, and build relationships of trust with our stakeholders.

Basic Policy

-

1.

Ensuring shareholder rights and equality

- ・ We provide shareholders with the necessary information to enable them to exercise their rights in a timely and accurate manner, and strive to create an environment for exercising voting rights.

- ・ When shareholders attempt to exercise their rights, the Company responds in good faith in accordance with laws.

-

2.

Cooperating appropriately with stakeholders other than shareholders

- ・ We commit to fulfilling our obligations and responsibilities to various stakeholders through the practice of our corporate philosophy, credos, code of conduct, and other relevant policies, and to building even stronger relationships of trust with them.

-

3.

Ensuring appropriate information disclosure and transparency

- ・ We strive to enhance trust in the market by proactively disclosing information to shareholders and investors at the right time.

- ・ We aim to realize transparent management by communicating smoothly with stakeholders through information disclosure.

-

4.

Responsibilities of the Board of Directors, etc.

- ・We set goals for enhancing long-term corporate value based on our corporate philosophy and determine the direction of the Company that will give concrete shape to the strategies and measures designed to achieve those goals.

- ・We continue to appoint Outside Directors to maintain and further improve the supervisory function of Directors in the execution of their duties.

-

5.

Dialogue with shareholders

- ・ We seek to communicate constructively with shareholders and investors by actively providing them with information relating to the Company’s financial conditions, progress on initiatives, and other similar matters not only at the general meeting of shareholders but also at financial results presentation meetings and other IR activities.

Board of Directors

The Company currently appoints 11 directors. Of these, six are outside directors, accounting for the majority. Moreover, two of directors are women.

The names of directors are as presented in the chart titled “Membership of the Board of Directors, the Audit and Supervisory Committee (previously the Board of Corporate Auditors), and the Nomination and Compensation Committee and the attendance and tenure of their members”. The Board of Directors is chaired by Chairman of the Board.

Drawing on the knowledge and experience they have acquired in their respective fields, the outside directors play key roles, particularly in relation to strengthening management functions and the Board’s supervisory function over business execution. Those outside directors who are not members of the Audit and Supervisory Committee are appropriately involved in determining compensation for officers, etc., and in nominating candidates for directors by,for example, providing reports to the Board of Directors as members of the Nomination and Compensation Committee.

The Company appoints directors, including outside directors,who are familiar with the industry to which the Company belongs as well as its business content and corporate functions and who possess a reasonable level of managementrelated knowledge, experience, and capabilities. The Company believes that all our directors currently have the backgrounds required to generate sound responses to major management issues and make prompt and decisive decisions. We also believe that the composition of the Board is suitably balanced in view of the Company’s size and type of business.

Our policy for the nomination of director candidates is to comprehensively examine and then select candidates based on their knowledge, their competencies in terms of accurate decision-making and supervision, and our expectations for their contribution to enhancing the Company’s medium to long-term corporate value.

In accordance with in-house rules, the Board of Directors makes decisions on basic policies regarding its business operations, important matters related to business management and execution, and matters delegated to it upon a resolution of the General Meeting of Shareholders along with other matters specified by laws, regulations and the Company’s Articles of Incorporation. The Board of Directors also receives reports on matters specified by laws and regulations and the execution status of important business operations, etc.

Audit and Supervisory Committee

The Audit and Supervisory Committee has four members,including one female member, three of whom are outside directors. The names of directors are as presented in the chart titled “Membership of the Board of Directors, the Audit and Supervisory Committee (previously the Board of Corporate Auditors), and the Nomination and Compensation Committee and the attendance and tenure of their members”. The Audit and Supervisory Committee is chaired by an internal director.

Outside directors each play an important role in establishing an objective and fair audit system. The Company seeks to strengthen management accountability and improve management transparency by appointing outside directors. The Company believes that it has an appropriate system in place for securing the trust of shareholders, investors, and other stakeholders.

In accordance with its audit policies and plans, the Audit and Supervisory Committee is engaged in the periodic exchange of opinions with representative directors, while its members attend important meetings, including those held by the Board of Directors and other various committees, even as they act in collaboration with accounting auditors and the Internal Audit Office and inspect the status of business operations and financial assets. Through these and other endeavors, the Audit and Supervisory Committee audits duties executed by directors.

Nomination and Compensation Committee

The Nomination and Compensation Committee has six members consisting of the Chairperson and Representative Director, Representative Director and President, and four outside directors who have no concurrent membership in the Audit and Supervisory Committee. The Nomination and Compensation Committee is chaired by an outside director.

The Board of Directors consults with and receives reports from the Nomination and Compensation Committee on the determination of compensation for directors (excluding directors serving as members of the Audit and Supervisory Committee) and the nomination of director candidates, with outside directors playing central roles at meetings of said committee in robustly deliberating these matters.

The Board of Directors pays maximum heed to those reports when making final decisions on compensation for directors (excluding directors serving as members of the Audit and Supervisory Committee) and the nomination of director candidates.

Executive Officer System and Management Council

The Company has appointed 16 executive officers (two of whom serve concurrently as directors). This system enables us to separate the Board of Directors’ decision-making and business execution supervisory functions from the Company’s business execution functions and to establish a management system that facilitates prompt and appropriate business execution. In addition, the Company has established the Management Council to serve as an organization for the Representative Director and President to discuss policies and plans for business execution and other important matters.

Risk Management Committee

The Company has also established a Risk Management Committee, which is chaired by the Representative Director and President and consists mainly of directors and executive officers, in order to appropriately manage various risks. The Committee regularly assesses risks and strives to identify and grasp problems, formulates and promotes risk response planning, and monitors the organization for risks.

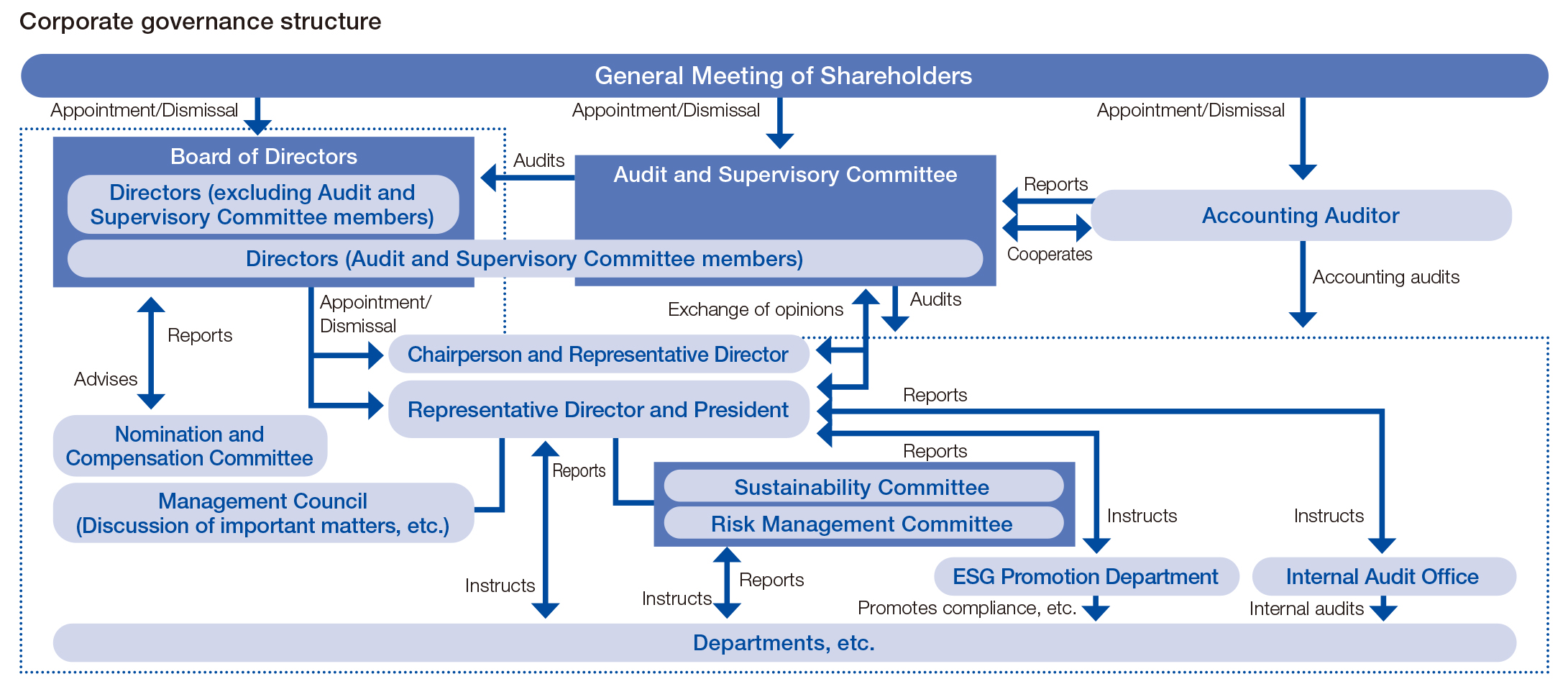

Corporate governance structure

Membership of the Board of Directors, the Audit and Supervisory Committee (previously the Board of Corporate Auditors),and the Nomination and Compensation Committee and the attendance and tenure of their members

| Official title or position | Name | Attendance in FY2022 (Attendance rate)*1 | Tenure | ||||

|---|---|---|---|---|---|---|---|

| Board of Directors |

Board of Corporate Auditors*2 |

Audit and Supervisory Committee |

Nomination and Compensation Committee |

||||

| Representative Director and Chairman | Koichi Nishida | 12/12 (100%) |

- | - | Member | 9/9 (100%) |

14years |

| Representative Director and President | Tomoaki Kitamura | 12/12 (100%) |

- | - | Member | 9/9 (100%) |

3years |

| Director and Senior Managing Executive Officer | Minoru Takeuchi | 12/12 (100%) |

- | - | - | - | 13years |

| Director and Managing Executive Officer | Isao Asami | 12/12 (100%) |

- | - | - | - | 4years |

|

IndependentOutside Director

|

Shinya Shishido | 12/12 (100%) |

- | - | Chair | 9/9 (100%) |

4years |

|

IndependentOutside Director

|

Shinichi Yamada | 12/12 (100%) |

- | - | Member | 9/9 (100%) |

3years |

|

IndependentOutside Director

|

Yumiko Masuda | 10/10*3 (100%) |

- | - | Member | 8/8*3 (100%) |

1years |

| Director and Full-time Audit and Supervisory Committee Member | Takao Sakamoto | 12/12 (100%) |

- | 8/8 (100%) |

- | - | 1years |

|

IndependentOutside Director and Audit and Supervisory Committee Member |

Taeko Ishii | 11/12 (91%) |

4/4 (100%) |

8/8 (100%) |

- | - | 1years |

|

IndependentOutside Director and Audit and Supervisory Committee Member |

Yutaka Takei | 12/12 (100%) |

4/4 (100%) |

8/8 (100%) |

Member | *4 | 1years |

|

IndependentOutside Director and Audit and Supervisory Committee Member |

Nobuyasu Iimuro | - | - | - | - | - | - |

*1 The above chart represents the FY2022 status of directors currently in office as of July 1, 2023 and, accordingly, does not include the status of directors who have retired.

*2 In accordance with a resolution passed at the 50th Annual General Meeting of Shareholders held on June 23, 2022, the Company transitioned to a company with an audit and supervisory committee organizational structure. Board of Corporate Auditors meetings were convened four times during FY2022 prior to this transition. For reference purposes, the above chart shows the number of these meetings directors attended and their attendance rates.

*3 Ms. Yumiko Masuda was appointed as a director on June 23, 2022. Accordingly, her data for the number of meetings attended and attendance rate are based on the number of meetings held (10 Board of Directors meetings and eight Nomination and Compensation Committee meetings) after she assumed the office of director.

*4 Mr.Yutaka Takei was appointed as a member of the Nomination and Compensation Committee on June 22, 2023.

Analysis and Evaluation of Board Effectiveness

The Company conducts an analysis roughly twice a year of the composition of Directors, the status of proposal submissions, the frequency of meetings, the appropriateness of meeting times, and the quality of comments and remarks. Directors actively speak out on the proposals raised, and the Board of Directors meets more frequently than is legally required and makes timely and appropriate decisions.

In addition, the Company has been analyzing and evaluating the effectiveness of the Board of Directors since FY2018 with the aim of improving the functions of the Board and enhancing corporate value. The outline of that analysis is as follows:

-

1.

Method of implementation

Implementation period: September to October 2022

Evaluation method: Self-evaluation by all directors,including those serving as members of the Audit and Supervisory Committee (13 directors, including seven outside directors) -

2.

Evaluation results

Regarding the evaluation results, the Company has confirmed that the sound effectiveness of the Board of Directors is ensured after receiving positive evaluations from all officers, including such comments as “the Board members were given sufficient time to intensively address each agenda item and able to have quite meaningful discussions” and “The composition of the Board has become more diverse than before due to the appointment of two female directors.” -

3.

Actions based on evaluation results, etc.

The Company has decided to promote the following initiatives to further improve the effectiveness of the Board of Directors.

• Stepping up the Board of Directors’ involvement in the selection and determination of agenda items up for discussion, including items newly established to enhance the quality of deliberations

Directors’ Compensation

The amount of compensation, etc., for directors who are not Audit and Supervisory Committee members (excluding outside directors), and the calculation method thereof, shall be determined upon the comprehensive consideration of past payment records and the Company’s performance. This compensation consists of fixed compensation, performancelinked compensation, and non-monetary compensation. On the other hand, compensation for outside directors (excluding directors who are Audit and Supervisory Committee members) shall consist of fixed compensation only.

Performance-linked compensation shall be paid as a bonus.This shall be calculated by (1) establishing a minimum criterion to be achieved for consolidated ordinary profit, (2) calculating the growth rate based on a comparison of that criterion and actual consolidated ordinary profit in the fiscal year for which the bonus is to be paid, and (3) multiplying the standard amount of performance-linked compensation by the aforementioned growth rate. Moreover, the degree of performance achievement compared with financial forecasts,and the degree of achievement of the medium-term management plan targets (financial and non-financial KPIs) shall also be taken into account when determining the amount of compensation.

However, in the event that business performance deteriorates significantly, the bonus may not be paid.

Non-monetary compensation shall be paid as stock-based compensation in the form of restricted shares and shall be calculated based on a standard amount determined in accordance with position in order to appropriately function as an incentive for the recipient to work to sustainably enhance the corporate value of the Company. The standard amount shall be determined annually, based on an assessment of corporate value (Company’s TSR compared with TOPIX growth rate), the degree of achievement of performance forecasts, and the degree of achievement of the medium-term management plan.

When determining the payment ratios for fixed compensation,performance-linked compensation and non-monetary compensation, the ratio of fixed compensation (basic compensation) shall decrease the higher the position, and the ratios of performance-linked compensation (bonuses) and non-monetary compensation (stock-based compensation) shall increase the higher the position. In cases in which operating results meet prescribed standards, the approximate payment ratios of compensation for directors who are not Audit and Supervisory Committee members of the Company (excluding outside directors) breaks down as follows: basic compensation: 62% to 71%; bonuses: 30%-23%; and stock-based compensation: 8%-6%.

The timing for payment of compensation for Directors who are not Audit and Supervisory Committee members (excluding outside directors) shall be monthly for basic compensation and once a year for bonuses and the stock-based compensation.

Fixed compensation (base compensation) for individual directors who are Audit and Supervisory Committee members is determined through discussion between the directors who are Audit and Supervisory Committee members, and performance-linked compensation (bonuses) and non-monetary compensation (stock compensation) are not paid to them.

Cross-shareholdings

Cross-shareholding policy

The Company holds shares in its customers’ and business partners’ firms for the purpose of maintaining and developing medium to long-term business relationships and also for the purpose of collecting information in anticipation of future business alliances.

Verifying the suitability of cross-shareholdings

To verify the suitability of holding these cross-shareholdings, theBoard of Directors examines and deliberates on the appropriateness of the purpose of each of the holdings every year.

In addition, we will reduce and otherwise reconsider shareholdings for which we have deemed the appropriateness of maintaining such shareholdings is not justified due to changes in circumstances or other such rationales going forward.

Criteria for exercising voting rights pertaining to cross-shareholdings

We comprehensively evaluate the pros and cons of proposals involving the exercise of voting rights associated with our shareholdings considering such factors as the financial and non-financial circumstances of the share issuing company, premised on the notion that appropriately exercising voting rights will help bring about greater value over the medium- to long-term and facilitate sustainable growth with respect to the issuing company.

Policy for Constructive Dialogue with Shareholders

The Company’s policy on establishing and implementing systems to promote constructive dialogue with shareholders is as follows:

-

1.

Dialogues with shareholders are supervised by the Director in charge of our staffing departments.

-

2.

Dialogues with shareholders are mainly managed by the ESG Promotion Department, and also appropriately dealt with by Directors and Executive Officers in accordance with shareholders’ wishes, etc. within a reasonable range.

-

3.

Information required for dialogues with shareholders is collected by the ESG Promotion Department from related divisions, and utilized for meaningful dialogues with shareholders within the scope in which disclosure is possible.

-

4.

The Company strives to enhance a means of communication through measures such as attending briefings, etc. for individual investors in addition to holding quarterly financial results briefings for analysts and institutional investors, as a means of dialogue other than individual interviews.

-

5.

The Company regularly reports opinions and requests, etc. of shareholders gained through communication with shareholders to the Board of Directors and utilize them for its management decisions.

-

6.

In order to appropriately manage insider information, the Company establishes the Rules Relating to the Management of Insider Trading and strives to thoroughly manage all internal information.

-

7.

The Company observes a quiet period spanning a few weeks prior to the announcement of its financial results in order to prevent any leakage of financial information and maintain impartiality. The Company refrains from providing answers to comments or questions, etc. received in relation to financial results during this period.

-

8.

The Company conducts a survey of substantial shareholders of the Company as necessary in order to conduct dialogues with the substantial shareholders.

-

9.

In order to improve dialogues with foreign shareholders, the Company appropriately formulates and provides the English version of documents that the Company deems useful for foreign shareholders.

Dialogues with shareholders held in the fiscal year ended March 31, 2023

-

1.

Main people engaging in dialogues with shareholders

- Directors responsible for oversight of staff divisions, General Manager of ESG Promotion Department (Executive Officer)

-

2.

Shareholders/investors with whom we held dialogues

- Investor relations (IR) activities:

Fund managers (68 firms in the fiscal year ended March 31, 2023) Analysts (18 firms in the fiscal year ended March 31, 2023) - Shareholder relations (SR) activities:

Persons in charge of ESG, persons in charge of exercising voting rights (21 firms in the fiscal year ended March 31, 2023) - *If the same company engaged in dialogues in both IR and SR activities, it has been counted in both categories.

- Investor relations (IR) activities:

-

3.

Main topics of dialogues and shareholder concerns

- ESG, business results, medium-term management plan

-

4.

Status of feedback to executive management team and the Board of Directors regarding shareholder views and concerns identified in dialogues

- IR activities:

Feedback provided to the Board of Directors every quarter (June and September 2022, January and March 2023) - SR activities:

Feedback provided to the Board of Directors once a year (April 2023)

- IR activities:

-

5.

Matters adopted based on dialogues and/or subsequent feedback

- Improvement of disclosures and the Integrated Report contents, information disclosure in line with TCFD Recommendations, disclosure of cash allocations

Information Disclosure

We appropriately and fairly disclose the corporate data needed for timely disclosure in line with investment securities listing regulations established by the Financial Instruments and Exchange Act and the Tokyo Securities Exchange as well as other corporate data that has a major impact on investment decisions. We also work hard to enhance the quality of disclosures, such as by expanding transparency and the content of disclosed materials.

DTS has built a system that ensures appropriate information management prior to disclosure. The directors in charge of administrative department are also responsible for handling information. Prior to disclosure, all important corporate information is swiftly reported to said directors responsible for handling information. Said directors confirm the content of the important information, consider the necessity for disclosure and methods of disclosure, and promptly report their findings to the Representative Director and President.

Important information that needs to be disclosed is swiftly disclosed after being deliberated on by the Management Council, which mainly comprises executive officers, and receiving approval from the Board of Directors. The Board of Directors meets as needed, and, after receiving approval,urgent matters are disclosed with the approval of the Representative Director and President and later reported on to the Board of Directors.

When disclosing information, in line with guidance of the directors responsible for handling information, the ESG Promotion Department discloses information through the Tokyo Stock Exchange’s TDnet and on our website.

Adobe® Reader® is required to view the PDF.

Click here to download Adobe® Reader®

Disclaimer

The earnings forecasts and future forecasts described in this material are forecasts made by the Company based on the information available at the time of publication and include potential risks and uncertainties. Therefore, please be aware that due to changes in various factors, actual business results may differ significantly from the stated future outlook.