DTS's Commitment to Climate-Change

Addressing climate change is one of the critical issues that require global efforts. If global warming continues at its current pace, it could potentially have significant impacts on various areas, including people's lives and economic activities.At DTS Group, we are committed to promoting decarbonized management by setting greenhouse gas emission reduction targets in line with the Paris Agreement. We also aim to realize a sustainable society through our response to international initiatives such as TCFD and SBT.

Disclosure in Line with the TCFD Recommendations

The DTS Group positions action on climate change problems as an important management issue and implements various measures accordingly.Since endorsing the Task Force on Climate-related Financial Disclosures (TCFD) in 2022, we have been working to expand disclosure of climate change-related business risks and opportunities.

Governance

The Company’s Board of Directors oversees the settingand implementation of targets and plans related to climate change risks and opportunities. The Board of Directorsalso monitors progress toward environmental impact reduction targets on a quarterly basis.The Sustainability Committee, chaired by theRepresentative Director and President and consisting mainly of Directors and Executive Officers, regularly assesses risks and identifies issues. The Committee also reviews key climate change strategies, such as the roadmap for achieving carbon neutrality and decarbonization management plans, with progress updates being reported to the Board of Directors as necessary.

Strategies

We analyze actual and potential impacts of climate-related risks and opportunities on the Group’s business, strategies,and financial plans and then disclose these, including the severity of impact and time frames (period of impact).In addition, with an eye to the highly uncertain future that is accompanying the shift to a low-carbon society, we have conducted the scenario analyses recommended by the TCFD for a sustainable 1.5°C world enabled by decarbonization or a 4°C world where greater economic development is expected, enabled by reliance on fossil fuels, rises in global temperature in order to determine the kind of business issues that might emerge. We found that,whether in the 1.5°C world or the 4°C world, there will be customer needs in a wide range of industries for new AI technologies, IoT, and DX action using the Company’s information technologies, as well as for energy-saving technologies related to customers’ efforts to shorten working hours. Thus, there will be climate change-related opportunities for business expansion. In particular, our quantitative analysis results indicate that in the 1.5°C world, we will see steady expansion in sales of maintenance and operation services, which are the Company’s core businesses. This finding reaffirms the great importance of achieving the Company’s 2030 net zero CO2 emissions goal. Accordingly, this enhanced our recognition Company’s development.that climate-related problems and the transition to a low-carbon society are strongly connected to the Company’s development.

Risk management

The Company’s Risk Management Regulations classify climate-related risks as sustainability risks, and these risks are comprehensively managed as business-related risks by the Risk Management Committee.The Sustainability Committee identifies climate-related risks and opportunities, evaluating them based on three metrics, namely, probability and—should they become prominent—quantitative impact and qualitative impact. In addition, climate-related risks and opportunities with a significant impact on the Group’s strategy are monitored regularly.

| Categories | Risks and opportunities | Indicators | Degree of financial impact |

Period of impact |

Relevant scenarios |

||

|---|---|---|---|---|---|---|---|

| Risks | Transitory | Policy and legal |

Increased procurement costs due to the introduction of carbon taxes and those costs being shifted to the operation contracting costs of partner companies | Increased costs |

Large | Medium term | 1.5℃ |

| Increased carbon taxes on electric power used by the Company | Increased costs |

Small | Long term | 1.5℃ | |||

| Increased offset costs resulting from addressing the difficult issue of reducing Scope 2 emissions amid delays in introducing renewable energy in buildings occupied by tenants | Increased costs |

Small | Medium to long term |

1.5℃ | |||

| Reputation | Decreased sales attributable to lost business opportunities resulting from a drop in market value due to failing to meet the decarbonization information disclosure demands of investors and other stakeholders(qualitative evaluation only) | Decreased sales |

Small | Medium term | 1.5℃ | ||

| Decreased sales due to customers switching to other companies due to delay in implementing energy-saving measures (qualitative evaluation only) | Decreased sales |

Small | Medium term | 1.5℃ | |||

| Technologies | Increased costs related to securing and training human resources in order to keep pace with accelerating DX | Increased costs |

Medium | Long term | 1.5℃ | ||

| Physical | Acute | Decreased sales due to being forced to suspend business activities as a result of an increase in extreme disasters | Decreased sales |

Small | Short term | 1.5℃/4℃ | |

| Chronic | Increased operational costs, such as for air conditioning, as average temperatures rise | Increased costs |

Small | Long term | 4℃ | ||

| Opportunities | Products and services |

Business expansion due to the promotion of low carbon-initiatives through productivity improvements as well as the leveraging of IoT and AI to digitize manufacturing sites and other production areas | Increased sales |

Small | Medium term | 1.5℃/4℃ | |

| Business expansion due to increasing needs for the further development of the car-embedded technologies we already provide as CASE progresses | Increased sales |

Small | Medium term | 1.5℃/4℃ | |||

| Business expansion as the residential solutions business addresses environmental problems and offers energy saving solutions that enhance the overall living environment | Increased sales |

Small | Medium term | 1.5℃/4℃ | |||

| Business expansion due to increasing demand for our proprietary services amid the accelerating digitalization of customer operations (going paperless) | Increased sales |

Small | Medium term | 1.5℃/4℃ | |||

| Business expansion in infrastructure and operation-related services that facilitate the increasing use of cloud services as a countermeasure for increasingly extreme disasters | Increased sales |

Small | Medium term | 1.5℃/4℃ | |||

| Business expansion related to supplying energy-saving services as customers’ work hours shorten | Increased sales |

Medium | Medium to long term |

1.5℃/4℃ | |||

| Business expansion in healthcare and medical-related services due to growing health concerns as temperatures rise | Increased sales |

Small | Medium to long term |

4℃ | |||

| Market | Business expansion with sales related to existing maintenance and operation services rising due to our increased attractiveness to customers thanks to achieving our net zero goal | Increased sales |

Large | Medium to long term |

1.5℃ | ||

* Degree of financial impact is determined as follows: Large: ¥2.0 billion or more; medium: ¥0.5 billion or more; small: below ¥0.5 billion or evaluated qualitatively only

Indicators and goals

The Group has established goals to reduce long-term greenhouse gas (GHG) emissions to achieve the goal of a less than 1.5°C rise in average global temperatures. In fiscal year ending in March 2024,We have obtained the SBT (Science Based Targets) certification, an international initiative, for our emission reduction targets for Scope 1, 2, and 3.

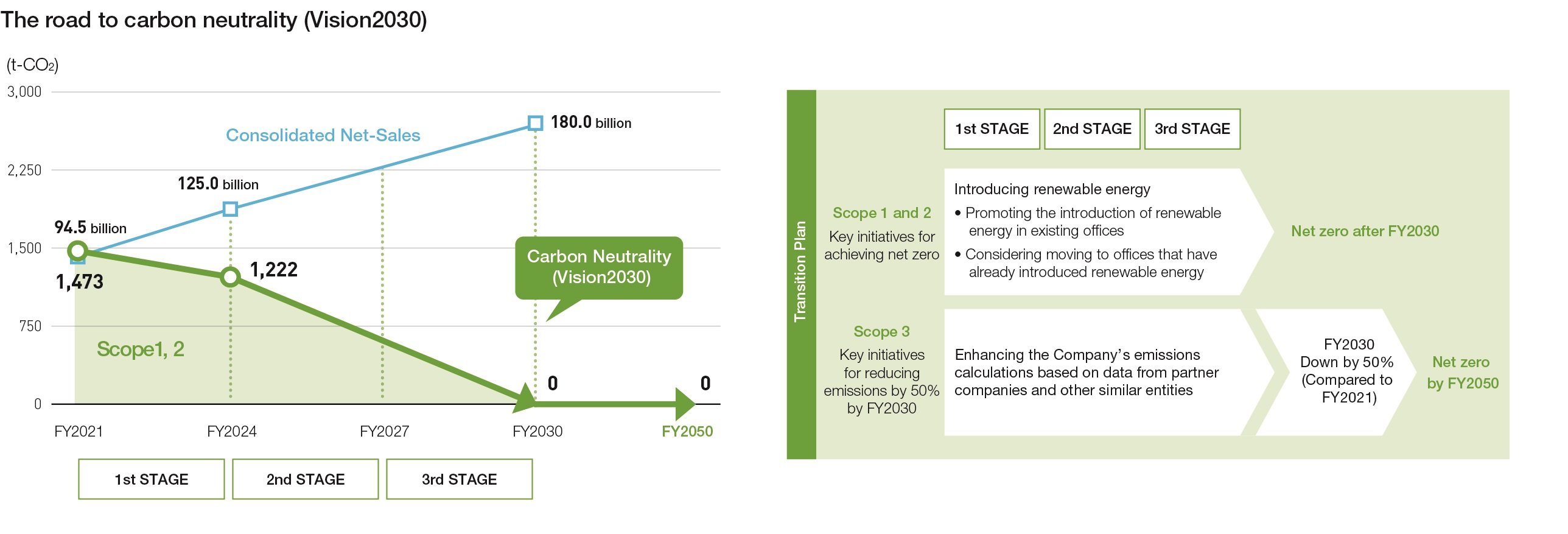

In line with the long-term Vision2030, the Group aims to achieve net zero CO2 emissions in 2030 for Scopes 1 and 2 and has set ambitious targets for Scope 3, aiming to realize carbon neutrality.

Greenhouse gas emissions targets

(Scopes 1, 2, 3)

| Item | Target | CO2 emission reduction rate target |

|---|---|---|

| Scope1,2 | FY2030 | Net zero |

| FY2050 | Net zero (maintain) | |

| Scope3 | FY2030 | 50% reduction (compared to FY2021) |

| FY2050 | Net zero |

External Recognition

CDP is an international not-for-profit organization that evaluates and discloses companies' environmental efforts in cooperation with institutional investors worldwide, who are highly interested in environmental issues.In accordance with the questionnaires on the three areas of climate change, forest, and water-security defined by CDP, companies and local governments disclose environmental data.CDP scores are widely used in investing and purchasing decisions toward a sustainable and resilient net-zero economy.It has been widely recognized as a global standard for environmental reporting, with its responses to climate change, deforestation, and water-security issues evaluated by the scores of D-from A.In 2024, more than 24,800 companies worldwide and 2100 companies, including more than 70% of Japanese companies listed on the prime market, disclosed environmental data through a CDP questionnaire.DTS has responded to the Climate Change Category questionnaire since 2022 and was selected for the first time as an "A-list" company with the highest rating.