DTS's Commitment to Climate-Change

In response to the increasing severity of climate change across the globe, the DTS Group has positioned responding to climate change as its top-priority environmental issue, and is working to reduce greenhouse gas (GHGs) emissions in line with the Paris Agreement. In line with Vision2030, its long-term outlook, DTS aims to achieve net-zero Scope 1 and Scope 2 emissions by 2030,as well as to realize carbon neutrality.

In addition, DTS has endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and discloses the progress of its initiatives in line with the TCFD framework, while also strengthening its initiatives for climate change and promoting decarbonization through management.

These initiatives have been recognized and DTS was selected as an A List company, the highest rating, for two consecutive years, by the CDP, a non-profit international environmental organization, in its Climate Change Report 2025.

Governance

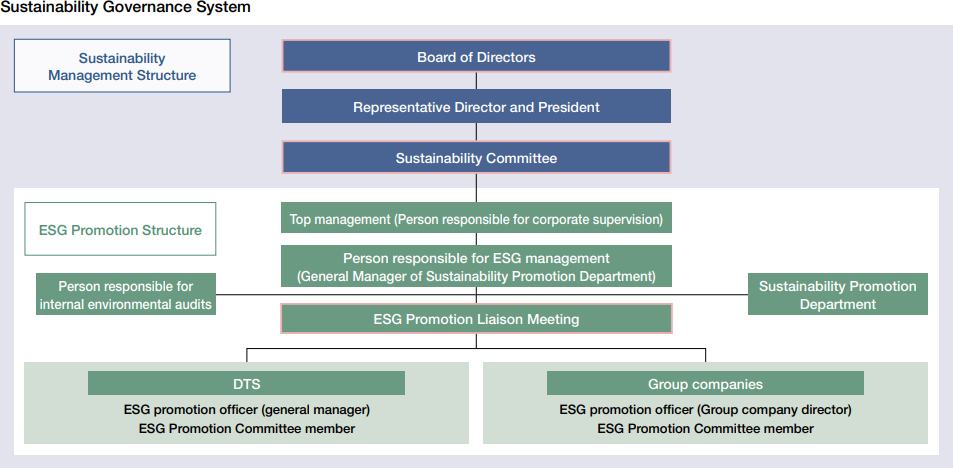

The DTS Group has created an environmental management system with the person responsible for corporate supervision heading up its management.

In 2022, we established the ESG Promotion Department (now the Sustainability Promotion Department) to promote a Group-wide response to climate change and thorough action to reduce environmental impacts.

Progress towards carbon neutrality and other aspects of the Company’s climate change response are periodically reported to the Board of Directors and the Sustainability Committee.

Strategies

We analyzed various climate change scenarios in accordance with the TCFD recommendations to understand potential impacts of climate risks and opportunities on the Group’s business, strategies, and finances. We analyzed risks and opportunities based on two scenarios: a 1.5°C scenario, in which the temperature increases since the Industrial Revolution is limited through low-carbon and decarbonization efforts; and a 4°C scenario, in which reliance on fossil fuels continues to increase GHG emissions and temperatures rise further.

- <1.5°C Scenario>

- In the 1.5°C scenario, society will shift focus towards more low-carbon options and decarbonization, and we can expect to see higher costs due to such new regulations as a carbon tax. In addition, there is the potential for a deterioration in the Group’s reputation if it is sluggish in responding to demand from investors and other stakeholders to disclose information on climate impact, or if such disclosure is unclear. However, if the Group’s response to climate change is sufficient, DTS would gain an advantage in providing sustainable procurement for customers, positively impacting business performance.

- <4°C Scenario>

- In the 4°C scenario, natural disasters such as large typhoons and heavy rains are expected to increase in severity and frequency,meaning that flooding and other weather risks have the potential to affect production at Group business sites. As clients strive to address these risks, we expect demand to grow for installation of cloud services as a disaster prevention measure from the perspective of corporate business continuity planning (BCP), and we expect this business to grow even further in the future.

Climate Change-Related Risks and Opportunities

| Scenarios | Categories | Risks, opportunities, and impacts |

Period of impact*1 |

Financial impact in 2030*2 (approximate) |

DTS response | |

|---|---|---|---|---|---|---|

| 1.5°C | Transition risks (Policy and legal) |

Increased costs due to the introduction of carbon taxes | Medium term |

Increased costs |

Sales, general, and administrative expenses + ¥27 million |

|

| Transition risks (Reputation) |

Worsened reputation due to failing to meet demand from investors for climate change-related information disclosure | Medium term |

Decreased stock price |

Market capitalization (¥1.73 billion) |

|

|

| Opportunities (Markets) |

If the Company responds sufficiently to climate change, customers will improve their sustainable procurement and sales will increase | Medium term |

Increased sales |

Sales + ¥200–¥400 million |

|

|

| 4°C | Physical risks (Acute) |

Frequent natural disasters such as large typhoons and heavy rains interrupt business activities due to flooding and other damage | Short term |

Decreased sales |

Sales (¥1.68 billion) |

|

| Opportunities (Products and services) |

Growing demand for cloud services as a countermeasure for increasingly extreme disasters | Medium term |

Increased sales |

Sales + ¥2.62 billion |

|

|

*1 Short term is within one year, medium term is one to three years, and long term is three years or longer

*2 Calculated based on data from FY2024

Risk management

The Company’s Risk Management Regulations classify climate-related risks as sustainability risks, and these risks are comprehensively managed as business-related risks by the Risk Management Committee.

Indicators and goals

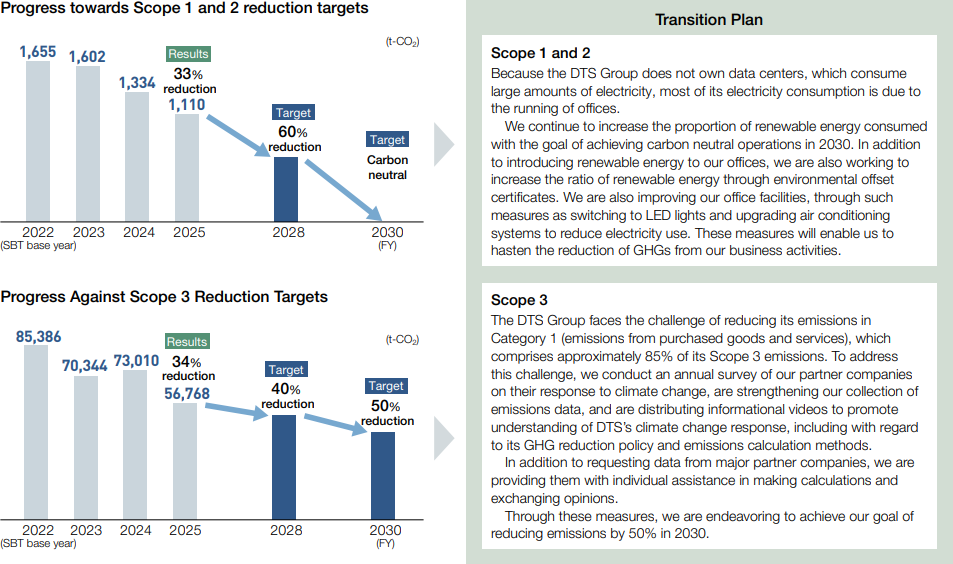

In the Vision2030 long-term outlook, the DTS Group aims to achieve net-zero Scope 1 and Scope 2 emissions by 2030 while also aiming to reduce Scope 3 emissions by 50% compared to FY2021. These targets were approved by the international initiative Science Based Targets (SBT) in February 2024.

As of FY2024, we have made steady progress towards these goals. The Company’s Scope 1 and 2 emissions have been reduced by approximately 33% compared to FY2021, and its Scope 3 emissions have been reduced by approximately 34%, putting both on track for 2030.

GHG emissions classification

| CO2 emissions | 2030 target (SBT) | 2050 target |

|---|---|---|

| Scope1,2 | Net zero | Net zero |

| Scope3 | Reduced by 50% (vs. FY2021) | Net zero |